Nowadays, everyone is trying to get hands-on experience in stock markets to yield better returns. While pursuing this, we might hear the words fundamental analysis and technical analysis a lot. But do we know what we actually mean by fundamental and technical analysis? How should we look at the measures to know which one will suit our needs? Let’s try to gain some understanding.

Overview:

Fundamental analysis of stocks is mostly done through the EIC approach. Here, we look at how the economy is performing, then look at the industry’s performance and growth, and then finally the company where we want to invest. It provides us with a holistic view of the company’s overall standing. It also gives you an idea of any threats that are present there.

On the other hand, technical analysis assumes that all these above-mentioned factors have been considered to reach the current trading market price of the stock. Hence, it takes the help of various graphs to buy or sell a stock.

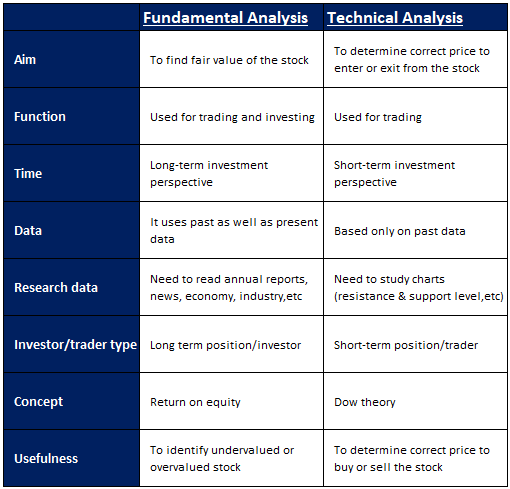

To understand it more clearly, let’s look at the difference between the two.

So which analysis should we prefer while picking up a stock? Fundamental or technical?

Well, it depends on the needs of an investor.

Time-Based relevance: If an investor wants to invest for the long-term, then it’s important to do fundamental analysis. This is because you are investing in the company and EIC will provide you with a good safety net. However, if you want to invest for the short term, then the technical analysis will be your preference. This is so because you are investing to make some short-term gains, and not investing for the growth of the company.

However, it’s not always the investment time that makes the difference.

If an investor sets aside some money to invest in stocks, he might want to do a fundamental analysis for a large number of stocks. It will enable him to create a bucket of some reliable and yielding stocks. Further, he might perform technical analysis on them to know when to buy which of these stocks. This approach is also followed by some of the major portfolio managers.

Conclusion:

Hence, it’s not about which technique is better, but about creating the right mix to yield the best returns on your investment.